Industries We Serve

As one of the largest back-end toll processing company in Korea.

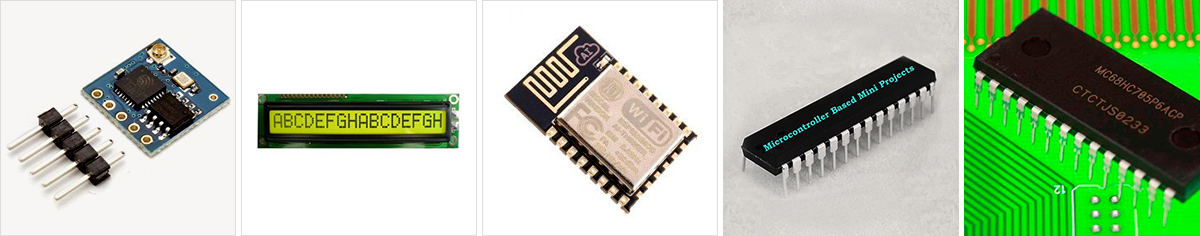

MCU

A microcontroller is a highly integrated circuit that comprises a CPU, I/O port, RAM, timers and some form of ROM – every element necessary for building a general purpose computer.

But unlike a general purpose computer, a microcontroller is designed to undertake only a very specific task or to control only a particular system.

As a result, the elements forming a microcontroller can be simplified and reduced, cutting down the production cost.

This has made the microcontrollers market a hotbed of activity globally.

Over the past decade, the market for microcontrollers has been characterized by innovation and breakthroughs.

They are commonly used in automatically controlled, stand-alone devices and products such as implantable medical devices, kitchen and household appliances, remote controls, power tools, toys, automobile engine control systems, to name a few.

As the complete mechanism needed to undertake any particular operation resides on a single chip in a microcontroller, their use makes it economical to digitalize and remotely control a wide range of devices and products.

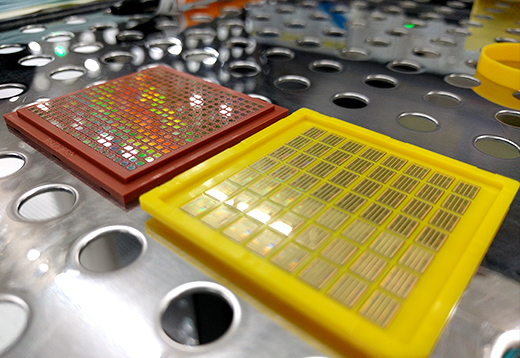

Outlook of the DDIC market

The MCUs used in IoT applications is on the rise, which is having a positive effect on overall MCU market growth.

The market for MCUs used in connected cars, wearable electronics,

building automation and other IoT applications is expected to grow at an overall CAGR of 11 percent, from $1.7 billion in 2014 to $2.8 billion in 2019.

The overall MCU market is expected to grow at a CAGR of just 4 percent through 2019.

Competitive landscape and key vendors

In 2015 Renesas Electronics led the EMEA region at 16 percent followed by Infineon, Texas Instruments,

STMicroelectronics and Freescale all separated by less than 2 percentage points.

In APAC Renesas Electronics led the market with 15 percent market share, followed by Infineon,

STMicroelectronics and Microchip – again, all separated by less than 2 percentage points.

Given that Renesas Electronics’ lead is narrow in these two regions, there are exceptional growth opportunities for many highly competitive MCU suppliers.

The top five companies in EMEA hold only 59 percent of their regional market, and the top five in Asia Pacific comprise just 54 percent of theirs.

With so many emerging economies in these regions, and the opportunities presented by Industry 4.0 initiatives, IoT connectivity and security in growing infrastructure markets, the opportunity for disruptive market shifts is moderate to strong.

Comprising 24 percent of the market share in the Americas in 2015, Freescale regained the leading market position from Renesas Electronics,

which had held the lead for a brief time in 2014.

Now with 14 percent market share,

third ranked NXP’s proposed acquisition of Freescale should significantly cement the merged company’s first-place ranking in the Americas.

In the Japan region, Japanese company Renesas alone is estimated to hold 70 percent of the Japanese market.

Spansion, was a distant second, with 12 percent market share, since the company previously acquired MCUs from Fujitsu and has not yet completed its merger with Cypress Semiconductor. Microchip posted 9 percent market share, followed by Toshiba at 5 percent and Infineon at 4 percent.